Bond Yields and Stock Market Ripple

So Yields are rising, why?

Few reasons are :

- Treasury bonds, several of them, entering market.

- Investors selling in the bond market.

- Banks – they want to raise capital, for several reason, they might sell bonds to do it.

- Hedge funds bets on futures, if some of them bet against yield rate increase, they may have invested heavily in bonds, as they realize the loss in betting against the yield, they tend to clear their portfolio in bonds.

Why investors are selling,

they are expecting growth sooner, also possible inflation. which would contribute to rise in yield rates sooner. If you think the yields (interest rates) will rise in the future, you don’t want to hold or buy bonds now.

Yields, which rise as bond prices fall, have rallied in response to expectations of a quickening pace of growth and inflation as the economy reopens from the coronavirus pandemic.

why bonds prices fall when yields rise? read here

Note:

US Treasury sells treasury bonds to raise money. There are two types, though vague classification just for understanding, one type are those bonds already in the market and the other type are the new bonds currently issued by treasury. Investors may buy or sell the old or new bonds depending on the yield. Naturally investors are attracted towards bonds if the yield is high, they are very attractive to investors especially in the phase of low growth in the economy. This idea may change when the economy is doing good, covered below on why.

If to reinvest? where to dump the money?

People can flock to commodities, currencies, etc., but ideally people shifted to riskier assets, in other words, investing in stocks as they are confident on growth in economy.

However, today is different, the recovery is coming after “PANDEMIC”, so now, investors are questioning the valuations of stock, they think they are overvalued, why? because growth companies benefitted largely from lower interest rates (lower yields) last year. Investors are concerned, if those companies continue to give same returns this year too and in addition with increasing yields?

when yields rise, it would be too much for company to take loans that may eventually ask the companies to cut down spending to raise profits, they may do so by cutting down employment, expansion, etc.., this is also a reason why stocks stumbled in recent weeks.

Other reasons are:

- the potential for more widespread economic growth – banks, energy, healthcare and other industries – high rates has reduced the relative appeal of tech and other growth oriented shares which benefited in the pandemic. Another thing to take a look at, there is a huge amount of uncertainty in the market at the moment as to whether the inflation that is widely expected in the short term is transient or whether it is more sustained.

- Stocks are looking expensive: Expectations of a stronger economy count as a positive development for companies’ earnings prospects, but they are also pushing long-term interest rates higher , with the 10-year Treasury recently yielding 1.47% versus 0.93% at the start of the year. That isn’t unusual, since long-term rates typically go up as the economy’s prospects improve, but then again stocks haven’t tended to be as expensive at the start of recoveries as they are now.

- As a result, even relatively modest moves upward in Treasury yields, and therefore the relative attractiveness of bonds to stocks, can cause market spasms. This is particularly true of the richly valued technology shares that have been among the biggest market winners since last spring.

- The Fed’s rate cuts during the past year helped fuel a wave of home sales and refinancing, but the recent climb in yields drove mortgage rates to their highest level since November this past week, and applications have dropped. That forces banks and other holders, such as real-estate investment trusts, to sell Treasuries to offset losses in mortgage bonds that happen when consumers stop refinancing.

- With also so much money in the economy, people fear of inflation and thus rising costs, which would affect company performance, with increase in yield rates (further?). Some money managers are betting that additional fiscal stimulus in the U.S. will boost inflation and cause the Fed to raise interest rates sooner than they had expected. That has led to a jump in real yields, or the returns on bonds after adjusting for inflation expectations.

All the above fears were partly comforted, when “Friday brought a dose of promising economic news, with the monthly jobs report showing employers added 379,000 new jobs in February, surpassing expectations. The unemployment rate ticked down to 6.2%. Those figures add to signs of slow improvement in the labor market, after data on Thursday showed filings for unemployment benefits reached their lowest level in three months.” But still, stocks wavered during Friday’s session.

So long as rising Treasury yields are driven by an improving outlook for the economy, the stock market may be able to absorb higher long-term rates. But that doesn’t mean the process will be smooth. One issue is that rather than gradually drift up, Treasury yields may instead have long periods where they stay relatively steady, and then jump quickly

Fed’s role :

We are coming out of pandemic and we want the growth based companies to contribute to the GDP. Higher yields, though, could also drag on the economy by increasing borrowing costs for individuals and businesses, leading some to think that the Fed might try to stop them from rising further. In other words, If fed let the yield rise, specifically growth companies will be affected, so we are expecting the fed to take some actions on increasing yields.

What can they do?

There are tools Feds uses to control monetory policies. they buy long term bonds to contain yields, they can manipulate short term interest rates.

Example:

Short term: The central bank has held its overnight federal-funds rate near zero since last March, 2020.

Long term: Fed has sought to suppress longer-term rates by purchasing, since last June, at least $120 billion a month of Treasury debt and mortgage-backed securities.

Investopedia is great source to read more about Fed role, read here

Why the fed is not limiting the yields?

Fed outlook is like let them raise, we want to ingest more money into the economy.

Mr. Powell said the recent increase in Treasury yields had caught his attention and suggested the Fed might intervene if overall financial conditions tighten much further. But he stopped short of signaling that the Fed was close to buying more long-term Treasurys each month in an effort to contain yields, as some investors had thought was possible.

“Today we’re still a long way from our goals of maximum employment and inflation averaging 2% over time,” Mr. Powell said Thursday during the interview.

He said the central bank will maintain ultra-low interest rates until its employment and inflation goals have been met, and will continue hefty asset purchases until “substantial further progress” has been made. Basically it means, pushing some more money into the markets.

These remarks did little to ease the fears on rising yields and now looking on the flip side, Investors and Fed officials alike say that rising yields generally reflect a brightening outlook, thanks to the distribution of coronavirus vaccines and large amounts of government stimulus . This is referring to the yield curve, which gives an outlook on the overall performance of the economy. look at the Treasury yield curve and this should make sense.

Do the yields continue to grow? Not really, Many portfolio managers say they believe rates are likely to flatten out in coming days as yields finally reach what they see as attractive levels. But those view can change too depending on the fed intervention to control the yields. Simply put, if the investors fears are not appeased, they may continue to sell bonds and that may further increase yield rates.

What are people thinking: possibilities

Without intervention, many analysts believe that yields could keep climbing this year, with the 10-year yield approaching 1.75% or even 2% as investors guard against the possibility that the Fed could start lifting short-term interest rates within the next few years.

Some, though, think yields are already higher than they should be, arguing that long-term forces are likely to contain inflation and make it difficult for the Fed to raise rates. If you have read about yield curve, you will know that yield rates do take into account the potential inflation rate, typically less than 2%.

Officials at the central bank have made clear that they plan to leave short-term rates near zero and keep buying Treasurys and mortgage securities until the economy is well on the way to health, but if the Covid crisis really does fade, Treasury investors may question the Fed’s commitment to keep buying assets in particular. That could lead to paroxysms in the bond market that agitate stocks as well.

It isn’t hard to envision situations in the months ahead where the Fed worries the Treasury market is getting ahead of itself and feels a need to calm the waters.

If the economy really does improve through the course of the year—an eventuality that, of course, depends on the fight against the pandemic going well—the stock market could be in for a period of general optimism punctuated by panicked, rates-driven selloffs. In other words, the market’s recent displacements could be just a preview of what is to come. This is because fed will raise the interest rates then as economy is improved

People think inflation will affect yields and growth companies but Fed doesn’t think so?

Many market participants also anticipate that a burst of spending once the economy fully re-opens will push inflation above the Fed’s 2% target, a situation that in the past would have prompted tighter monetary policy.

But more than a decade of weak inflation led Fed officials last year to swear off raising interest rates in anticipation of rapidly rising prices. Mr. Powell said last week that the Fed doesn’t foresee lifting its benchmark fed-funds rate from near zero until three conditions have been met: a broad range of statistics indicate that the labor market is at maximum strength, inflation has hit its 2% target, and forecasters expect inflation to remain at that level or higher.

Is there a way to see inflation expectations?

A key measure of investors’ inflation expectations also surged recently. Five-year breakevens—which reflect the expected pace of price increases over the five-year period that begins five years from now—climbed above 2.5% for the first time in 13 years before closing at 2.487% Wednesday, according to Deutsche Bank.

Yields on Treasury inflation-protected securities, or TIPS, which are a proxy for the real yields, have also shot upward.

The five-year break-even rate—a measure of expected annual inflation over the next five years derived from the difference between the yields on five-year Treasurys and the equivalent Treasury inflation-protected securities— hit 2.4% in recent days , the highest since May 2011.

“The question is whether 2% inflation can be sustained once we reach it,” said Matthew Hornbach, global head of macro strategy at Morgan Stanley . He said the scale of U.S. fiscal stimulus means that inflation “has a very reasonable chance of getting to 2% and staying there.”

At the same time, the recent uptick in Treasury yields hasn’t only reflected increasing inflation expectations, as was essentially the case earlier in the year. Over the past two weeks, yields on Treasury inflation-protected securities—a proxy for so-called real yields—have also shot upward, with the 10-year TIPS yield rising from roughly minus 1% to minus 0.7%.

That move has caught investors’ attention because many credit deeply negative real yields with helping power stocks to records, pushing yield-seeking investors toward riskier assets. Real yields were around zero percent or higher from the middle of 2013 through the start of 2020, meaning they might have more room to rise even after their recent move.

related: ‘Real’ Bond Yields Help Explain Surprising Market Moves – WSJ

Any signs that people started looking into stocks?

For now, many investors are moving into assets that are less vulnerable to swings in rates. Stocks are less competitive with bonds when yields rise. Shares in some of the most popular technology stocks , including Amazon.com and Apple, have fallen from their highs in the past month.

Note:

This article captures my perspective / line of thought, questions and their answers I gleaned from the content published across several WSJ articles over several weeks. This is an attempt to connect the dots between stock markets and treasury bonds.

Resources:

Good to know:

- why yields rise when bond prices fall

- why bonds are considered safe haven

- yield curve

- Correlation between bonds price and stocks price

- bonds and stock behavior ( other commodities too) in the stages of Inflation, Deflation, Stagflation.

- Monitory policy vs fiscal policy

Iran – Iraq – US (Sunni, Shia, Khurds – pretty minority in iran and iraq)

- [iarn, Venezuela, Lebanon – anti Israel]

- Iraqi insurgency (2003–2011) -part of the Iraq War – Wikipedia

- Iraqi insurgency (2003–2006) – 2003–2006 phase of the Iraqi insurgency – Wikipedia

- Iraqi Civil War (2006–2008) – multi-sided civil war in Iraq – Wikipedia

- YouTube – how ISIS former – small bit from 14:30 min timestamp

- Iraqi insurgency (2011–2013) – following the withdrawal of U.S. troops from Iraq – Wikipedia

- War in Iraq (2013–2017) – armed conflict between ISIL and Iraq- Wikipedia

- ISIL insurgency in Iraq (2017–present), continued ISIL insurgency following territorial defeat

The whole US-Middle East timeline

- How US stole Middle East

YouTube – 1930 US had no presence in Middle East (Saudi). A company discovered oil in Saudi. It starts from there. first military build started. This gives good explanation about what all you need to know about US and fights within middle east - The Middle East’s cold war, explained

YouTube - A Brief History of U.S. Intervention in Iraq Over the Past Half Century

(starts from 1958, briefly tells saddam position, and saddam actually rose to full power in 1979) – gives some intro about iraq and its type of ruling from 1958 YouTube

Notes: iran, iraq, saudi – mostly war for religion, oil and power.

US backed Saudi since 1930 – since the discovery of oil there.

US backed Iran starting from Shah govt until 1979 Iranian revolution where khomeneni toppled the west favored monarchy govt by shah. Khomeneni wanted islamic government.

Suadi was also afraid (religious threat and Saudi is sunni dominated) of this Iranian revolution, and favored US for the support

The United States backed Iraq during the Iran-Iraq War (1980–1988) with the strategic goal of toppling Ayatollah Khomeini’s revolutionary government in Iran. This support was motivated by two key factors: Iran’s 1979 revolution had overthrown the US-favored Shah, and Iran was reportedly planning to empower Shia populations in Iraq—a development that threatened Saddam Hussein’s Sunni-dominated regime. Initially, US involvement was characterized by a cynical approach of letting both nations weaken each other through prolonged conflict. The US was not genuinely pro-Iraqi; American officials recognized Saddam’s brutality but nevertheless wanted Iraq to prevail as a counterweight to Iranian revolutionary influence.

At the height of Saddam’s brutality, including his use of chemical weapons, the Reagan administration actively supported the Iraqi regime. In a significant move to facilitate military assistance, the US removed Iraq from its list of state sponsors of terrorism. This enabled Washington to supply weapons to Baghdad, including attack helicopters that were subsequently used in chemical attacks against Kurdish populations. This policy reflected a broader American stance: any force opposing Islamic revolutionary expansion was considered an ally, regardless of its domestic conduct. Consequently, the US befriended and materially supported Saddam’s dictatorship throughout the 1980s.

US military engagement with Iraq shifted dramatically following Iraq’s 1990 invasion of Kuwait, leading to the 1991 Gulf War. President George H.W. Bush framed the intervention in humanitarian terms—emphasizing the protection of Kuwaiti sovereignty and civilian rights. However, the US military campaign intentionally targeted and destroyed Iraq’s raw infrastructure on a massive scale. Despite having the capability to overthrow Saddam entirely, American leadership deliberately stopped short of regime change. The strategic calculation was that Saddam remained useful as a regional bulwark against Iranian revolutionary expansion, so the war ended with his regime intact.

Following the Gulf War, the Clinton administration continued aggressive policies toward Iraq throughout the 1990s. President Bill Clinton authorized periodic bombing campaigns and maintained crippling economic sanctions on the country. These measures, combined with the destruction from the previous war, devastated Iraq’s economy and civilian infrastructure between 1989 and 1998. The Iraqi population suffered tremendously from this sustained pressure, even as Saddam’s regime clung to power.

Gradually, the US government began planning for regime change in Iraq, constructing a case for invasion based on claims that Saddam possessed weapons of mass destruction and harbored terrorists. While intelligence supporting these allegations was limited and disputed, planning for military intervention proceeded effectively. The September 11, 2001 attacks provided the catalyst and political environment for full-scale military action. In 2003, the United States launched a comprehensive invasion to topple Saddam Hussein—a move opposed by both Saudi Arabia and Iran, each for their own regional reasons.

Following the invasion, the US appointed Paul Bremer to administer occupied Iraq. Bremer implemented a policy of de-Ba’athification that barred all members of Saddam’s Ba’ath Party from government service. This proved disastrous because party membership had been essentially mandatory for professional advancement under Saddam; even those who despised the regime had joined out of necessity. Overnight, approximately 250,000 soldiers and officials were fired and left unemployed. This policy inadvertently unified Sunnis and Shias against the American occupation and directly contributed to the emergence of the Iraqi insurgency.

The Iraq War became increasingly controversial domestically, contributing to Barack Obama’s 2008 presidential campaign, during which he promised to withdraw US troops and opposed the war’s continuation. Following through on this commitment, American forces largely departed Iraq in 2011. However, the security vacuum and ongoing instability necessitated their return several years later as the situation deteriorated.

After Saddam’s fall, Iraq’s power vacuum created opportunities for both Sunni and Shia armed groups to seize control. Sunni militias received support from Saudi Arabia, while Shia factions were armed and backed by Iran. This external sponsorship fueled a devastating sectarian civil war within Iraq. Iran positioned itself as an anti-status quo power seeking to expand its influence, while Saudi Arabia faced its own pressures as pro-democracy and anti-monarchy protests inspired by the 2011 Arab Spring threatened the kingdom’s autocratic, theocratic monarchy.

Iranian military forces and allied militias—including extremist groups like Hezbollah—fought alongside the Assad regime in Syria’s civil war, supporting the dictator against various opposition forces. Among these opposition groups were Sunni militias, including the terrorist organization ISIS. ISIS emerged from the chaos of post-Saddam Iraq, drawing disaffected Sunnis and former military personnel into its ranks. The group established presence in both Syria and Iraq, becoming a dominant force in the regional conflict.

By 2021, ISIS had been largely defeated as a territorial force in both Iraq and Syria through combined military efforts. With the immediate terrorist threat diminished, Saudi Arabia and Iran have resumed their competition for influence over Iraq’s political future. Saudi Arabia continues to support Sunni military and political factions—distinguishing these from terrorist groups—while Iran maintains its backing of Shia militias and political parties. The struggle for dominance in Iraq remains a central feature of the broader regional rivalry between these two powers.

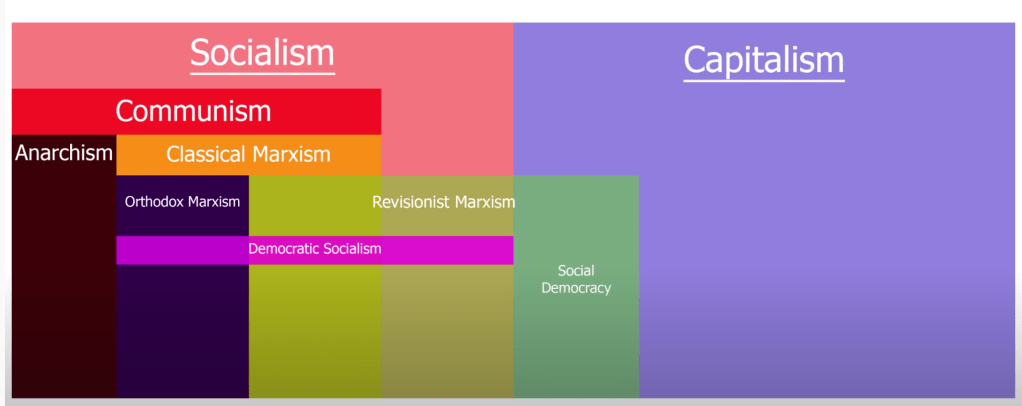

Communism – socialism – capitalism : socialism / socialist – depends on who we are talking to

Because some think socialism is closed related to communism with some minor differences.

Now a days, socialism meaning has changed bit.

The Difference Between a ‘Socialist’ and a ‘Democratic Socialist’